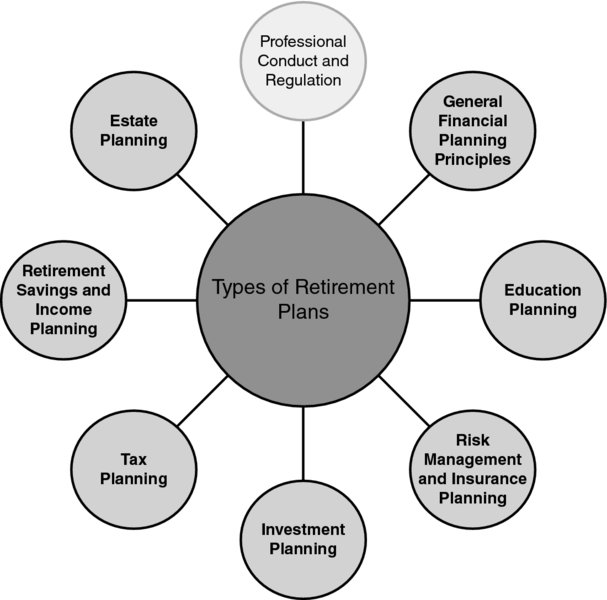

Retirement Planning Fundamentals Explained

Wiki Article

Retirement Planning Fundamentals Explained

Table of ContentsExcitement About Retirement PlanningExamine This Report about Retirement PlanningWhat Does Retirement Planning Do?Get This Report about Retirement PlanningUnknown Facts About Retirement PlanningRetirement Planning Things To Know Before You Buy

A 401(k) match is likewise an extra affordable method to provide a monetary motivation to your staff members, as your service will be paying much less in payroll taxes than if you supplied a typical raising or bonus offer, and also the employee will also receive even more of the money since they will not have to pay extra income tax obligation - retirement planning.For instance, 1. 5% might not seem like a lot, but simply a passion substances, so do costs. This money is instantly subtracted from your account, so you may not right away see that you could be conserving thousands of bucks by relocating your possessions to an affordable index fund, or switching companies to one with reduced financial investment fees.

If you have certain pension where you can contribute with funds with taxes you've paid now vs. paying tax obligations upon the withdrawal of the funds in retired life, you might desire to think about what would conserve you much more in tax obligation payments with time. If you have certain much shorter term investment accounts, consider how much cash you 'd spend there (and consequently pay taxes on in the close to future) vs.

The Single Strategy To Use For Retirement Planning

We think that instead of feeling the pinch post-retirement, it's sensible to start saving early. What you just need to do is to start with a possible conserving, plan your financial investments and also with a long-term commitment. The method you wish to spend your retirement entirely rely on the quantity of cash you have actually conserved as well as invested.

Rumored Buzz on Retirement Planning

Meeting their hefty medical expenses as well as other demands along with individual family members requirement is really extremely hard in today's era of high inflation. retirement planning. For this reason, it is a good idea to begin with your retired life financial savings as early as you are 20 years old and also solitary. The retirees position a substantial problem on their household who had actually not prepared and conserved for their retirement.There's always a wellness problem associated with expanding age. There may be a scenario where you can not work any longer as well as the financial savings for retirement will certainly assist to ensure that you are well cared of. The large question is that can you pay for the expense of long-lasting treatment because it can be really costly as well as is consisted of in the price of your retirement.

Do you intend to maintain functioning after your retirement? If the solution is no, then you should start with your savings. Individuals that are unprepared for retirement frequently need to maintain functioning to accomplish their family's requirement throughout life. It is extremely unlikely that you will produce income forever, hence, cost savings play an important function.

Some Known Details About Retirement Planning

Nonetheless, if you begin late, it might happen that you have to sacrifice or readjust on your own with your pre-retirement and also retired life way of living. The amount that you require to conserve as well as add each period will depend upon exactly how very early you start conserving. Beginning with webpage your retired life preparation in the twenties may seem as well early for your retirement.

Starting early will allow you to create excellent retirement savings and planning routines and also give you more time to rectify any mistake and to recognize any kind of shortfall in attaining your goal - retirement planning.: Capture up on your Retired life Preparation in your 50s The retirement plans ought to be developed and carried out as soon as you start functioning.

These economic organizers will take into consideration various variables to perform retired life assessment that includes your earnings, expenses, age, desired retirement lifestyle and so forth. Hence, use the sweat of your golden years to give a shade in your old days to ensure that you depart the globe with the sensation of complete satisfaction and efficiency.

4 Simple Techniques For Retirement Planning

There is a typical misconception among young staff members, and also it frequently sounds something like, This Site "I have plenty of time to get ready for retirement. There's no need to rush." Others believe, "As soon as I get my financial resources sorted, I'll begin thinking of retired life." 1. If you wait for the "excellent" or "appropriate" time, you'll never ever start.

The earlier you start, the far better. Nonetheless, it's never ever far too late to begin. my explanation With these 2 concepts in mind, employees can be motivated to prepare for retirement immediately. Neither their age nor their existing financial resources must can be found in the way of retired life preparation.

What Does Retirement Planning Do?

Numerous of us postpone sometimes also the most effective individuals, obviously! When it comes to saving for retirement, hesitating is not encouraged.Based on information from the Office for National Statistics they had 6,444 of disposable earnings per head in 1977. In 1982, they had 7,435 of disposable revenue per head. By 1987, they had 8,565 These couples are all the same age The essential difference in between them is, they didn't all begin to save for their retirements at specifically the very same time.

They determined to save 175 per month (2,100 per year). 29 percent of their annual earnings. They got low-cost shared funds, placing 70 percent of their cash in stocks, 30 percent in bonds.

Report this wiki page